22+ mortgage property tax

Web The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayers qualified gross income QGI and a specified rate based on the taxpayers QGI. You Can Pay Your Property.

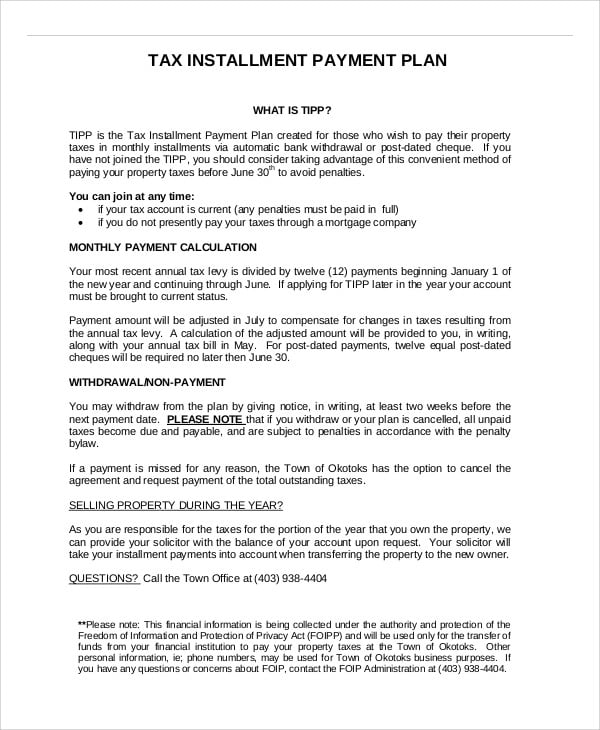

22 Payment Plan Templates Word Pdf

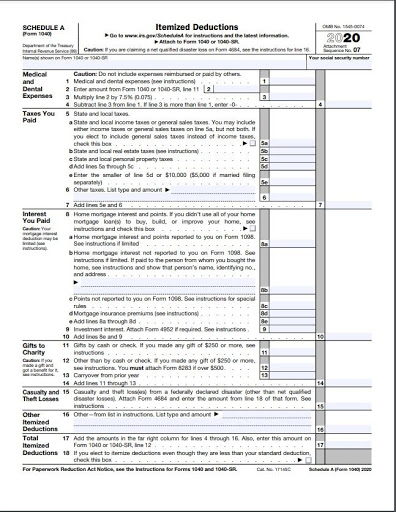

Web The standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for.

. Web If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill. Save Real Money Today. If youre using an escrow account to pay property taxes dont deduct the amount you put in escrow.

Web For example a lender might make the payment in October to cover the total amount of the following years taxes or they might make quarterly payments. Owning property in Wyoming however will only put you back roughly 057. You Might Be Allowed To Pay Your Property Taxes With a Credit Card.

Web Thanks to the Tax Cuts and Jobs Act of 2017 you can only deduct up to 10000 combined from your property taxes and state and local income taxes. Web Whether your property taxes are impounded monthly or paid twice a year you can still deduct up to 10000 in total state and local property taxes Greene-Lewis. Use NerdWallet Reviews To Research Lenders.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web If the real property is principally improved or to be improved by a one- or two- family residence or dwelling the first 10000 of principal debt or obligation secured by. Web In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease.

Lock Your Mortgage Rate Today. Web 20000 Monthly Tax Paid 7200000 Total Tax Paid 8333 Monthly Home Insurance 3000000 Total Home Insurance 2817867 Annual Payment Amount 84536023. If you qualify for.

Web Mortgage Recording Tax Return MT-15 420 General information Use Form MT-15 to compute the mortgage recording tax due when the mortgaged real property is located. The maximum credit allowed is 350. Thats a maximum loan amount of roughly 253379.

Enter Any Address Now. Homeowners who bought houses before December 16. When an owner fails to pay property.

You must include 10000 in your income in the first. Ad Its Faster than Ever to Find Property Taxes Info. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Looking For A Mortgage. Ad Were Americas Largest Mortgage Lender.

Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. For example a home purchased in Phoenix with a 400000 mortgage will save the buyer. You Get a Tax Break Because of Your Property Taxes.

Were Americas 1 Online Lender. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Property Tax Bills.

It depends on the taxing. Browse Information at NerdWallet. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

We do not mail you a Property Tax Bill if your property. To claim the credit the computed amount must exceed 250. Uncover In-Depth Assessment Information on Properties Nationwide.

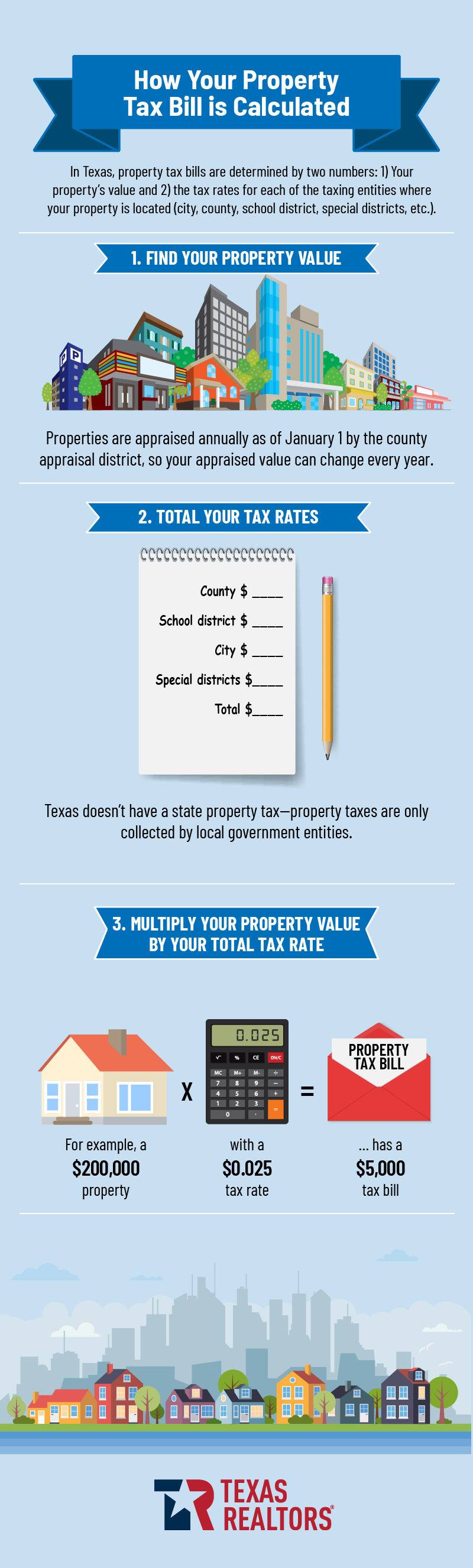

Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Bills are generally mailed and posted on our website about a month before your taxes are due. Web His condo which he bought for 2 million in 2010 was one of more than 360 properties in the citys December 2021 lien sale.

Its A Match Made In Heaven. Deduct the amount of taxes you actually pay. Ad Learn More About Mortgage Preapproval.

Web 2 days agoIn areas where home prices have shot up the savings will be greater. Take Advantage And Lock In A Great Rate. Most state and local.

Web For example New Jersey has the highest average effective property tax rate in the country at 242. Web Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month.

Grundsteuerreform Property Tax 2022 This Is What You Need To Do Now Ghar In Germany

What Is Property Tax Everything Homebuyers Need To Know Credible

Portugal Mortgages Taxes And Expenses To Pay Idealista

Understanding Property Taxes Home Loans

Property Tax Education Campaign Texas Realtors

A Property Tax Reckoning Is Coming Housingwire

Grundsteuerreform Property Tax 2022 This Is What You Need To Do Now Ghar In Germany

What Is Property Tax Everything Homebuyers Need To Know Credible

How Property Taxes Are Calculated

Property Taxes In Germany 2022 German Properties

Tax And Loan Advice

How To Budget Your Money In 4 Simple Steps Financial Planning Printables Money Management Advice Personal Finance Budget

Wfc2022

North Dakota Property Tax Relief Probably Won T Last Say Anything

How Do Property Taxes Work Dpaul Brown Realtor

Home Loan Guide For Geelong Home Buyers Investors Awfs

7 Free Sample Mortgage Presentation Templates Printable Samples